Did You Know That You Can collect GST For Online Education?

- September 11 2017

- Ranjan

We all are aware of the GST rule. Last July Indian Government has replaced all the taxes on goods and services with the Goods and Services Tax; in a more “One tax to replace all” manner. But did you know that if you are an online teacher, you can also charge GST for the online education, that you offer? Yes, you heard me right. As per the GST rulebook states, any coaching institutes are also eligible to charge GST on the course sale.

GST for Online Education

Goods and services tax has been introduced in last July. It says that, if you are offering any service to anyone or you are selling any sort of goods then you can charge GST. Now you might be wondering that how teaching can involve GST too. Well, this is where I will first explain it to you and oh I have another great news for you. The other news will surely take you to the edge of your seat. Let me first tell you about the GST.

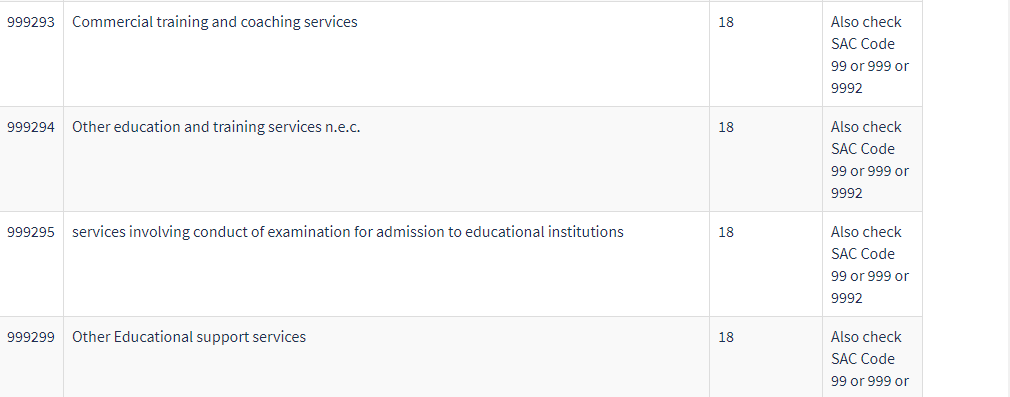

So as per the recent disclosure, online training institutes have also been listed in the services section.

As you can see in the above image, all the kinds of teaching, have been included in the list. And that means you can collect GST from your learners, to compensate for the GST that you have to pay. (You can see the full list here).

Special News:

Now, since I have promised special news, I guess it’s time to break the news to you. Initially, it was decided that businesses with turnover above 20L can register for GSTIN. But in the revised model the limit has been removed and now you can apply for GSTIN. That means if you are in the middle tier of the teaching business where you are getting software assistance for your online school and then teaching the students, then you can claim the input GST, irrespective of your annual turnover. Isn’t this the news you were waiting for since the announcement of GST?

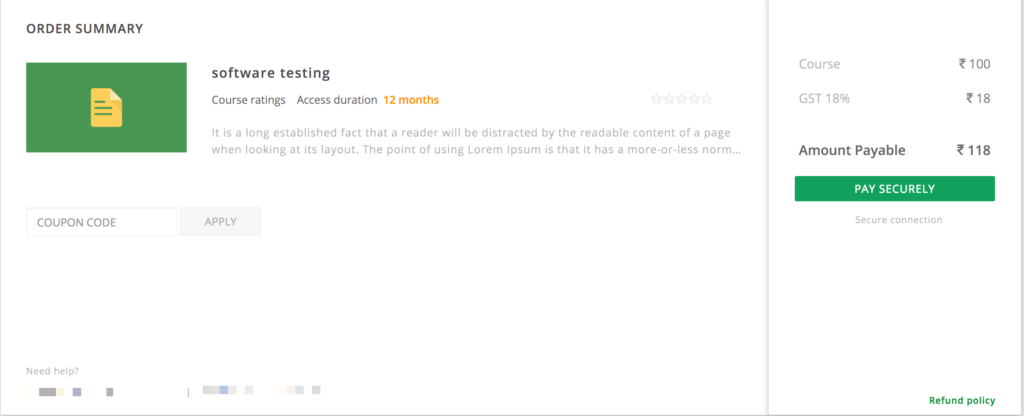

Becoming GST Compliant with Learnyst

We at Learnyst take care of your technological needs, but our relationship just doesn’t end there, right? So when we heard of these new changes we have proactively developed the GST compliant checkout page for your learners. If you have registered your business for GSTIN then you can easily charge the GST from your learners.

So if you are an online educator or test prep institute then you can sign up on the Learnyst platform and easily become GST compliant.

If you have any doubts or questions on how to add GST to the online course. feel free to drop your comments below.

Leave your thought here